Understanding investment risk

Understanding investment risk

Before you start investing it’s important to have clear understanding of your risk tolerance and risk capacity. Together, they can help you narrow down which types of investments are best suited to help you achieve your financial goals.

- Risk tolerance your willingness to take risk, which may potentially impact the size of the reward.

- Risk capacity the amount of risk you can afford to take. Your age, income level and time horizon normally influence your risk capacity.

Investments that have the potential to earn you bigger returns also include more risk, leaving you a bumpier ride. If you’re looking for a smoother sailing, defensive investments may offer more protection but might not return enough to get you where you want to go. It’s important to know what your financial goals are and make decisions that meet your risk tolerance and within your risk capacity.

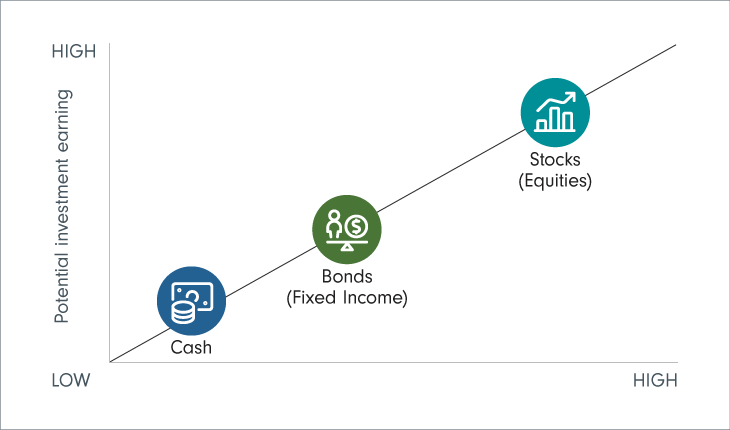

The risk and return relationship

Every investment type faces a number of risks. With stocks, there’s the risk that a news headline or an influential tweet could spook the markets. With bonds, different economic environments and changing interest rates can send prices up or down. If you’re new to investing, take your time to make sure that you understand the investment risk and return associated with stock, bonds and cash.

Here are a few examples of how your risk tolerance can influence your investment strategy.

- An aggressive investor is willing to use high-risk growth strategies in the quest for higher returns. However, an aggressive investor must also be able to withstand substantial fluctuations in account value.

- A moderate investor might be more incline to balance their portfolio risk by using diversified portfolio containing a mix of lower-risk choices along with a few higher-risk options.

- A conservative investor is willing to accept lower returns for the safety of their capital. These investments often include, bonds, cash, and money market accounts.

Bottom line

When it comes to risk, it’s a decision that only you can make. Don’t expect your decision to align with other investors, everyone’s risk tolerance is going to be different. Some investors may be comfortable with more risk than other investors even if they share the same goals and time horizon.