What is an ETF?

What is an ETF?

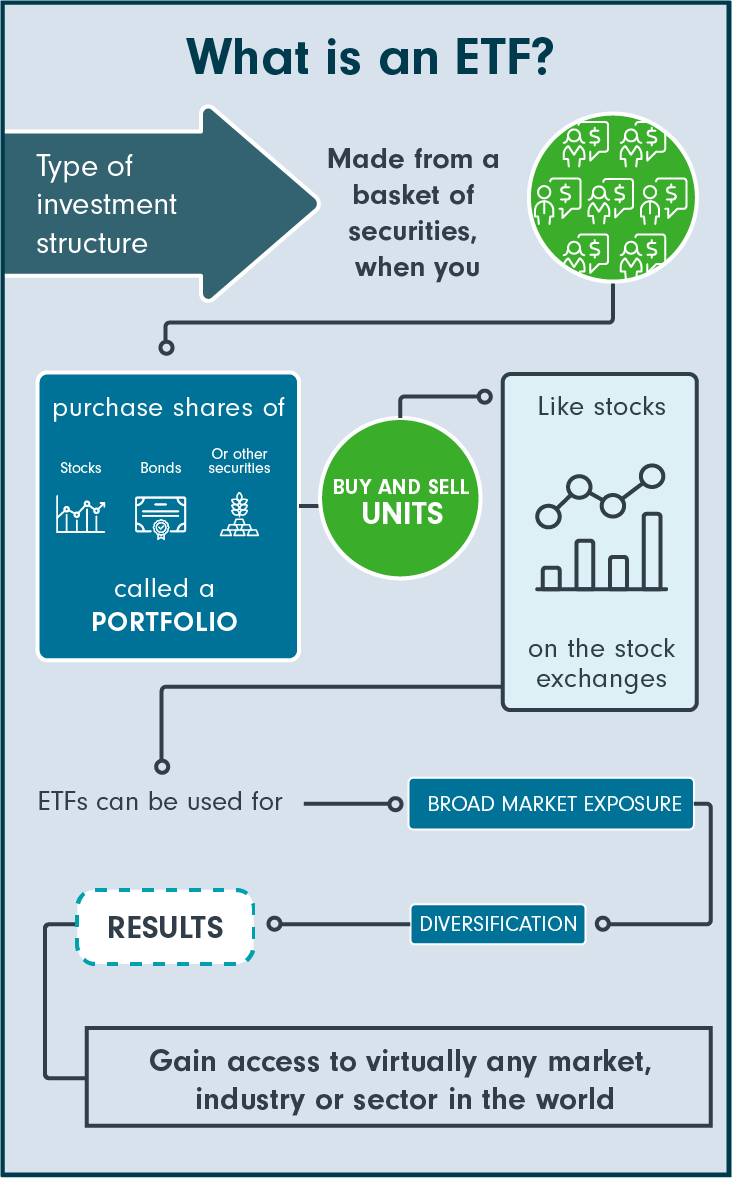

Exchange-traded funds, or ETFs, are a type of investment structure made up of a basket of securities that trades like a stock and can be bought or sold at any time during the trading day.

When you, the investor, invest in an ETF, you do not actually own the securities (stocks, bonds, etc.) in which the fund invests; you only own shares in the ETF itself. ETFs can be used to gain access to virtually any market industry or sector in the world.

A unit in an ETF is also called a “share,” and the combined holdings of the ETF are known as its “portfolio.” Investors buy shares of an ETF and are called “investors,” “fund holders” or “unitholders.” The number of outstanding shares can change daily because of the continual creation of new shares and the redemption of existing shares.

Once you have determined your investment goals, ETFs can be used to gain exposure to virtually any market or industry sector in the world. While ETFs offer a number of benefits, including low cost and myriad investment options, ETF investing can lead investors to make unwise decisions. In addition, not all ETFs are alike. Management fees, execution prices and tracking discrepancies can cause unpleasant surprises for investors.

How do ETFs work?

With ETFs, you can add diversification to your portfolio with a single trade. ETFs can provide trading flexibility, liquidity and lower costs than other investment vehicles. Let’s run through some basic definitions to help understand where and how ETFs are purchased and traded.

Much like stocks, ETFs trade on a stock exchange. The exchange provides the infrastructure and services for brokers and traders to buy and sell stocks, shares and other tradable financial assets called “securities.” You’ll find stock exchanges all around the world, such as the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE), Nasdaq, the London Stock Exchange (LSE) and the Japan Exchange Group (JPX).

-

Investor

An investor places an order with the broker. An ETF has a ticker symbol, and its intraday price can be easily obtained throughout the trading day.

-

Broker

The broker enters the order in the exchange. A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange. You can purchase an ETF through a brokerage house or platform. Like stocks, ETFs are bought and sold during the day when the major exchanges are open, and they are priced continually during normal exchange hours.

-

ETFs share

The order is filled and ETF shares are delivered to the investor.